Retirement Annuity Investment - A hidden surprise

by Ankie Engelbrecht

Health warning: The Retirement Annuity (RA) investment discussed below, is the “new” generation investment RAs – not insurance (or policy) RAs. Both products enjoy exactly the same tax benefits, but investment RAs have no maturity date, are more flexible and carry no penalties – in sharp contrast to insurance RAs which gave RAs a bad name.

Income tax benefits from RA investments release some tightness in your monthly budget instantaneously – a relief not available from an investment outside of the retirement fund domain. Although these tax benefits are so tangible upfront, they will not necessarily last throughout retirement. Post-retirement, these tax benefits are often eaten up by the income tax payable on the income produced by your pre-retirement savings. If you are, however, in a lower tax bracket post-retirement, you will pay less tax post-retirement than the tax benefits you received pre-retirement. [1]

RA investments offer other tax benefits as well. For instance, you do not pay dividend withholding tax (DWT), capital gains tax (CGT), death taxes (estate duty), or tax on interest earned within an RA. The absence of these taxes is not immediately felt in your pocket. Their compounding effect over time, however, silently bolsters the capital to pay an income post-retirement. As a result, an RA investment significantly outperforms a similar investment amount in a non-retirement fund that remains subject to these taxes.

In this article we are going to quantify the absence of two taxes – DWT and CGT – on the performance of an RA investment. The benchmark to measure such outperformance is an equity unit trust fund investment outside of the retirement fund domain. The investment inside the RA fund is the exact same equity unit trust fund, but it is exempt from DWT and CGT.

The absence of dividend withholding tax (DWT)

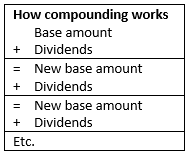

A DWT of 20% is charged on dividends within the benchmark investment. Such an investment, therefore, re-invests only 80% of its annual dividends. Since the RA does not re-invest diluted dividends annually, but the full dividends, its new base amount will expand more rapidly than in the case of the benchmark investment. (See the textbox.)

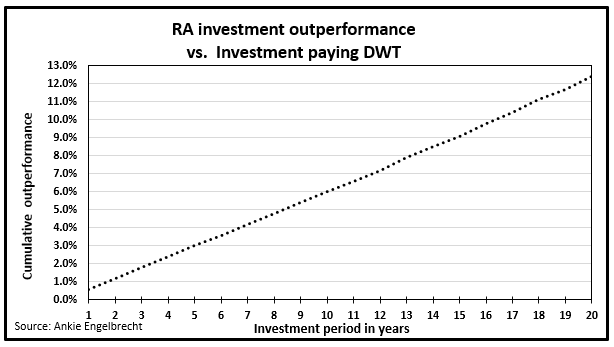

The longer the investment period, the more potent this compounding effect becomes for creating extra wealth. Consequently, the RA is expected to outperform the returns of the benchmark investment by increasing margins – as shown in the chart below. For instance, after 5 years the value inside the RA will be 3% higher than the value inside the benchmark investment. This outperformance increases to 6% after 10 years, 9.1% after 15 years and 12.4% after 20 years. Such outperformances speak volumes. DWT partially eats away the performance of an equity unit trust fund that is not included in an RA. (See the chart below for outperformances over other investment periods.)

The absence of dividend withholding tax (DWT) and capital gains tax (CGT)

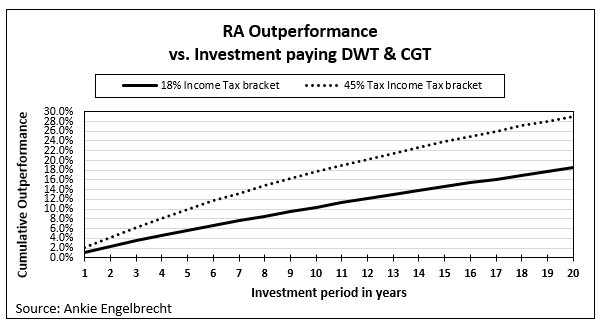

The outperformance of an RA investment balloons further when CGT is also excluded from the RA investment. Note, not all the capital gains are subject to tax – only 40% of the capital gains are taxed at the marginal income tax rate of the taxpayer. Thus, those in a higher tax bracket will pay more CGT than those in a lower tax bracket. Therefore, those in the higher tax bracket will get greater benefits from not paying more CGT than those in the lower tax brackets. For instance, RA investors in the 45% tax bracket will do 17.7% better in an RA fund after 10 years, than with the benchmark investment paying DWT and CGT over the same period. Those in the 18% tax bracket will do 10.4% better over the same period. After 20 years, an income taxpayer in the 45% marginal tax bracket will be 29.1% better off and the taxpayer in the 18% tax bracket will do 18.5% better, because both these taxpayers have RA investments which do not pay DWT and CGT. See the chart below for outperformances for the above mentioned two tax brackets over other periods as well. The outperformances for other tax brackets fall between these two extremes.

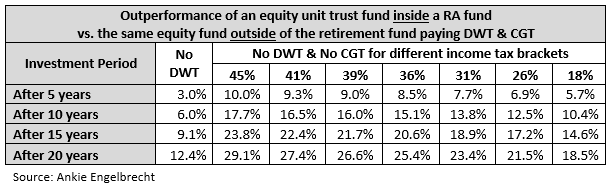

The outperformances for all the marginal income taxpayers are indicated in the table below.

Interpretation of the outperformances indicated on the table above and elsewhere:

Assume the initial lump sum investment made in the benchmark fund 10 years ago is now worth R1 mil after DWT and CGT. For an RA investor in the 18% tax bracket, the same equity fund inside an RA fund will deliver an extra 10.4% on the R1 mil of the benchmark investment. This corresponds with an additional R104 000 from an RA investment. Similarly, an RA investor in the 45% tax bracket gets a an extra R177 000 from an RA investment over the same period.

These outperformances are based on an initial lump sum equity investment, expected to register capital gains of 10% per annum[2] and an annual dividend yield of 3% over all the investment periods concerned, with dividends re-invested annually. The annual exclusion of capital gains is ignored in the calculations above. It is further assumed the RA investment is confined to the maximum equity portion of 75%, which is the upper allowable limit for equity exposure under Regulation 28 of the Pension Fund.

Due to the magical effect of compounding, better outperformances will result, if the capital gains are expected to exceed 10% per annum. (See earlier discussion on compounding.)

Final remarks

This analysis shows hidden tax benefits in an RA investment. They enable the RA investment to outperform DWT and CGT paying investments by a large margin. Such outperformance will counter the lower income many of us experience post-retirement. Moreover, the outperformance will be irrespective of whether you get any income tax benefits from an RA investment, or not.

Since excess contributions in RAs do not qualify for income tax benefits, a good case could be made for making excess contributions in RAs. “Excess” in this context refers to contribution amounts exceeding the limit SARS places on RA investment contributions that would qualify for income tax benefits. Note, such a SARS limit only restricts the amounts that would qualify for income tax benefits, but it does not prevent investments in excess of the tax benefit limit amount.

The option of making excess RA contributions is not a luxury reserved for the super-rich only. Someone who has inherited money, or has sold off a secondary investment property, or a farmer who has sold off his farm, etc. – basically anyone should consider investing the proceeds from such assets in RAs, even though there may be minimal income tax relief in the process. [3,4] Hence a larger pool of investors, more than just the super-rich, could also benefit from excess RA investments. They will also reap the tax benefits of not paying taxes on dividends and capital gains.

Footnotes:

[1] In all fairness, extra tax rebates (which are not available pre-retirement) become available as you age post-retirement. With every extra rebate the tax threshold income level, where you would need to start paying income tax, is lifted.

[2] In reality the annual % capital gains will differ over 5, 10, 15 and 20 years. Such differences, however, will not

change the principle of outperformance, since both investments have the same annual % capital gains. The

benchmark investment just applies the same annual capital gains rate on lower capital values throughout the

investment period – hence the benchmark investment benefits less from compounding than the RA investment.

[3] Note, income tax benefits from RA contributions are only possible if you have a proper source of taxable

income.

[4] For excess contributions inside RAs, both estate duty and lump sum withdrawal taxes might be triggered or not

on death of the original RA investor. Estate duty could be triggered on the nominal values of the excess

contributions. (“Nominal” refers to the initial excess investment amounts. Nominal values are actually ‘clean’ of

subsequent returns on them). Lump taxes could be triggered on the subsequent returns generated on the

nominal values of the excess contributions. How the RA beneficiary wants to take the RA death benefit – as a

lump sum or as an income – will determine whether both these taxes are triggered. The lump sum option triggers

both the mentioned taxes in the ‘hands’ of the deceased. The income option (through a living or life annuity)

does not trigger the mentioned taxes, but it triggers income tax in the hands of the beneficiary. A further analysis

is needed to weigh up the pros and cons of each option. It remains crystal clear, however, that RA investments

which qualified for income tax benefits, are exempt from estate duty. This is an additional benefit of an RA

investment versus the benchmark. It will further increase the margin by which an RA investment will outperform

the benchmark investment. The latter outperformance is not quantifiable in this case study due to the

methodology it followed.

Disclaimer:

This article is not meant be conclusive financial advice. It merely shares interesting information. With too many missing pieces of the puzzle it cannot be a blanket solution to everyone. The reader should consult a financial advisor to compile a financial plan that serves his/her particular needs and circumstances.